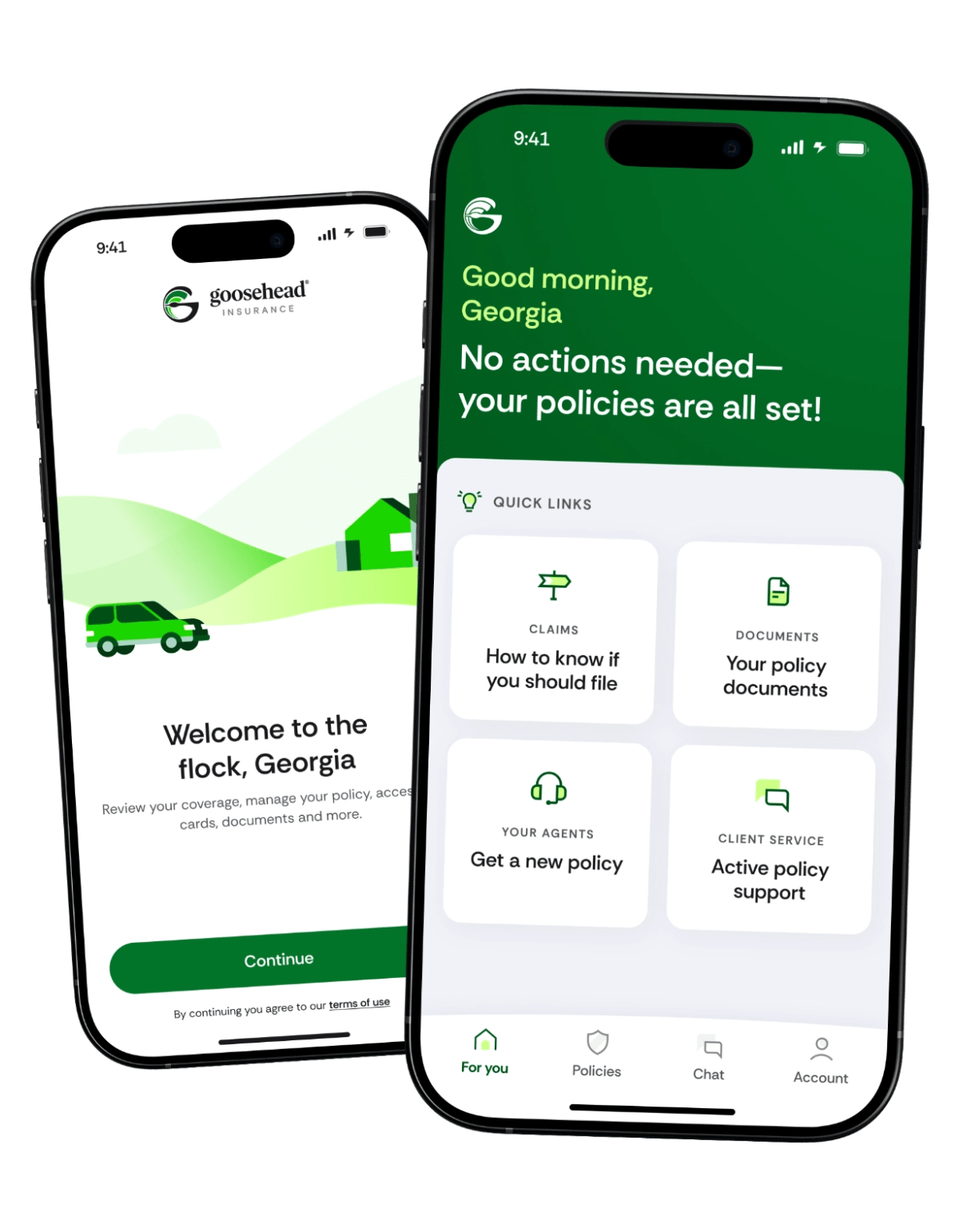

Goosehead Insurance, a rapidly growing and innovative independent personal lines agency, saw an opportunity to give its clients an intuitive mobile app for reviewing and managing their policies. Eager to explore new possibilities with a product and design partner, Goosehead met with vendors to hear proposed strategy plans; ultimately engaging with Fueled in early 2024 for a short strategy and design sprint to shape the vision.

After collaborating on strategy and design with our product designers, Goosehead extended a 5-week project into an 18-month engagement, signing off on the app’s development. Fueled became deeply embedded in Goosehead’s team, bringing our expertise to the project from the initial roadmap to a live product. The product continues to evolve as part of a deepening partnership set to continue until at least 2027.

Designing Features with Customer-Centricity

In the initial five-week sprint, we worked closely with Goosehead stakeholders to define the app’s core features, user journeys, and visual design. Through workshops, we mapped what Goosehead clients needed most—from quick access to policy information to real-time chat support. To really understand the pain points clients faced, we shadowed service agents as they helped clients through key use cases. We also performed key competitive analysis to discover what features other popular insurance apps had, and what innovative self-service features would set Goosehead apart. By the end of this sprint, we presented an interactive prototype and a clear product roadmap that validated the vision and set the foundation for full-scale development.

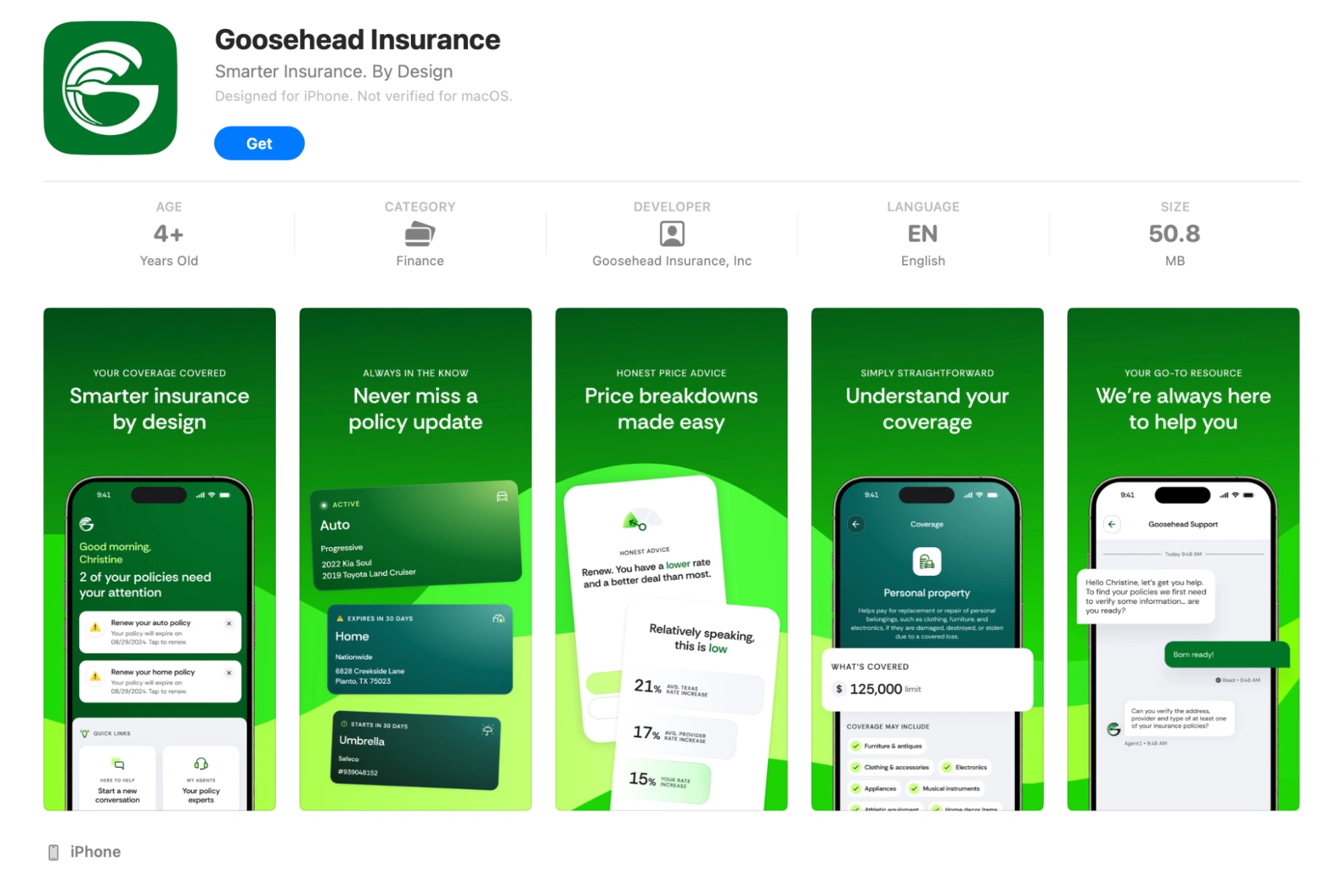

The information-rich, user-centered app brings Goosehead’s services straight to clients’’ fingertips. Key features included:

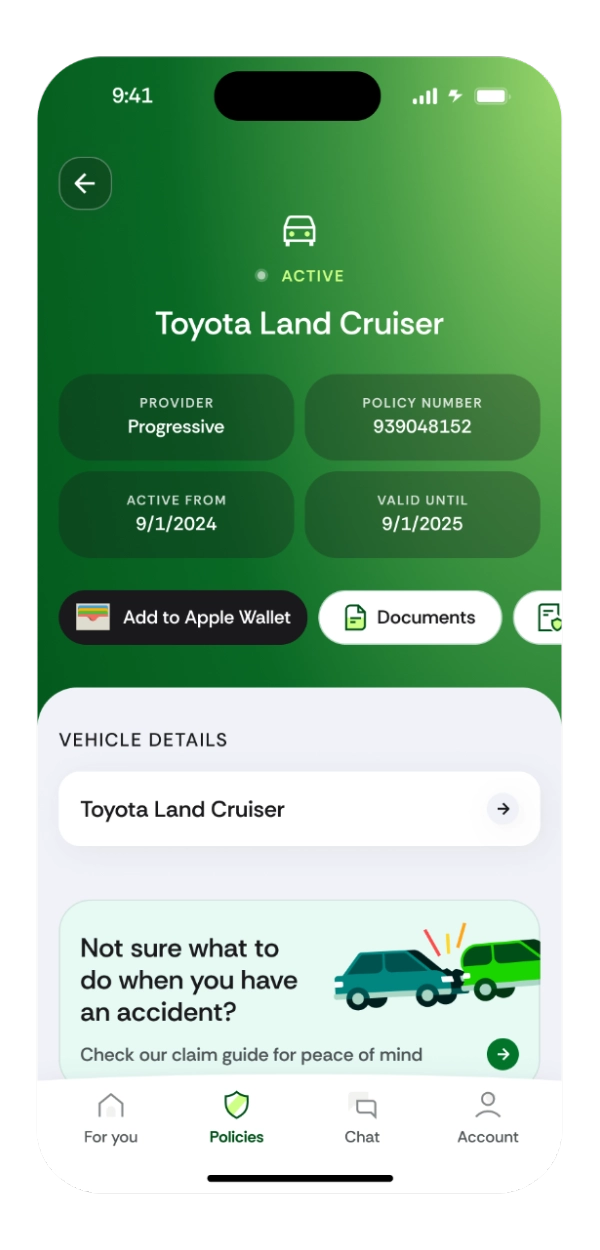

- Comprehensive Policy Information: Clients can view their insurance policies in the Policy Hub, with key details, coverage summaries, and updates. Active policies are front and center in the Policy Hub, with past policies accessible for reference, giving clients a full picture of their insurance history. Home and auto policies have embedded education with common examples provided, so clients understand each aspect of coverage.

- Digital Insurance: No more rummaging through glove compartments. Auto insurance customers can access a digital version of their insurance anytime. The app even allows clients to save the card to their phone’s wallet (on iOS) or as a downloadable and shareable file, making it easy to pull up insurance information on the go.

- In-App Chat & Support: The app features an integrated chat support system that connects clients with Goosehead’s service agents. A smart chatbot helps define users’ questions and helps hand off to a live agent with pre-populated information that helps speed up case resolution.

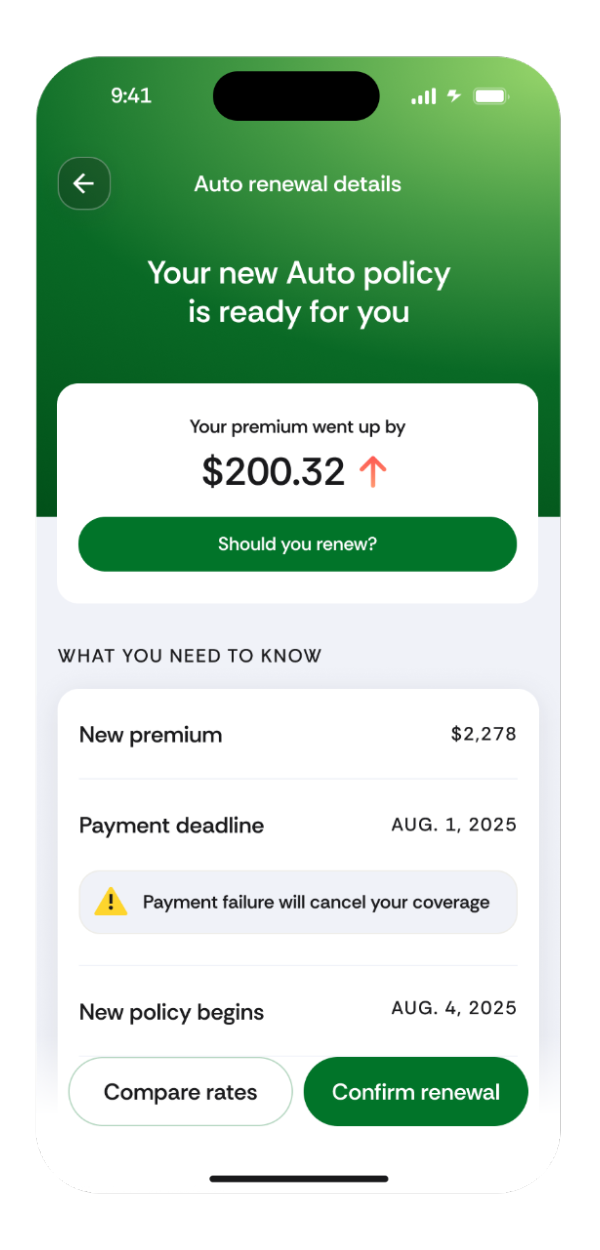

- Policy Renewals Made Easy: Clients can review their upcoming renewal details, compare options, and confirm their policy renewal right in-app. If a client wants to explore other options before renewing, the app’s comparison feature can connect them with their agent to shop for better rates or coverage. The app uses data to provide clients with a clear understanding of what their renewal means and why Goosehead recommends one policy over another.

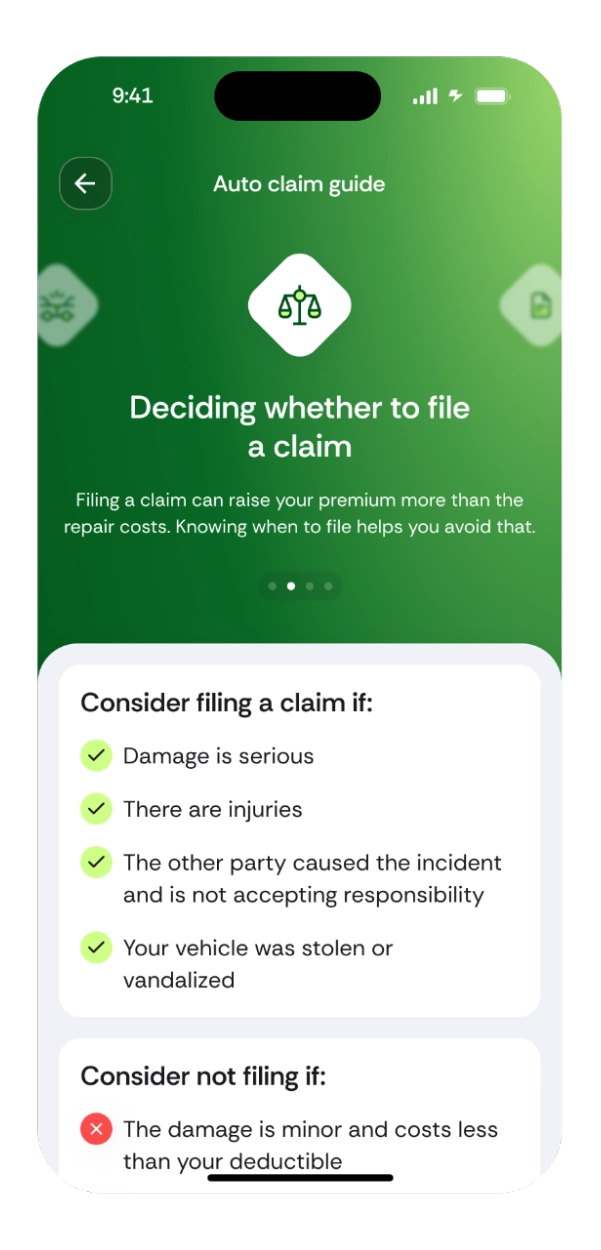

- Claim Guidance: In the stressful moments after an incident, the app’s built-in Claim Guide provides step-by-step assistance. It educates clients on what information to gather and how the claims process works. This empowers clients to make informed decisions and initiate claims with clarity on what comes next.

Fueled iterated on wireframes and did usability testing (with Goosehead employees and sample users) to ensure non-technical customers could navigate the app with ease. We broke down insurance language into clear, everyday wording, and key actions (like “Policy Details” or “View Card”) are always just a tap or two away. By focusing on the end-to-end user experience, we delivered an app that not only handles complex data, but does so in a way that makes clients’ lives easier.

Challenges Spanning Product Design and Technology

Delivering Goosehead’s app meant solving for enterprise complexity on multiple fronts:

- User Trust & Clarity: We had to distill complex information (coverages, claims processes, renewal details) into an interface that any client could navigate with confidence. Every feature—from digital ID cards to claim guides—needed to be reliable, crystal clear, and embedded with education to earn user trust.

- Phased Rollout: Because Goosehead represents hundreds of different insurance carriers and 23 lines of business, releasing the app to all clients at once wasn’t feasible. We needed to launch in waves, onboarding groups of users at a time to ensure every client had a smooth experience.

- Data Complexity: Insurance policies come with massive amounts of data and legacy record-keeping quirks. The app had to securely handle sensitive policy details, documents, and updates in real time, all without slowing down or compromising accuracy and performance.

- Enterprise Integration: Goosehead’s backend systems centered on Salesforce (housing thousands of insurance policies and client records), and their web tools were built with React. We needed a solution that aligned with their infrastructure without disrupting it.

Architecting a Cross-Platform Solution

To meet Goosehead’s enterprise infrastructure requirements, Fueled architected the app with a robust, scalable tech stack aligned to their environment. We chose React Native as the foundation for the mobile app, allowing for a single cross-platform codebase for both iOS and Android. This not only sped up development, but also meshed perfectly with Goosehead’s React-based web infrastructure.

For a few platform-specific requirements (for example, integrating with Apple’s Wallet for digital insurance cards on iOS), we wrote targeted native modules in Swift (iOS) and Kotlin (Android). This hybrid approach ensured the app felt fully native on each platform while maximizing shared code and consistency. We also leverage Tailwind through NativeWind in the React Native app, giving us a unified design system across platforms. With this setup, design updates could be applied uniformly, keeping the UI consistent and on-brand for all clients.

On the backend, we built a powerful API layer using NestJS, a Node.js framework known for its modular and enterprise-ready design. This new backend acted as a bridge between the mobile app and Salesforce, orchestrating data flow and business logic.

We also implemented an authentication layer via Auth0 to secure sessions and endpoints, integrated with Goosehead’s own Quote Generation API, and set up background workers to handle policy and quote notifications as well as ongoing data syncs between systems. Whenever the app needs to fetch the latest policy info or update a record, the NestJS service handles the request, applies any necessary processing, enforces auth, and interfaces with Salesforce’s APIs—offloading heavier tasks to background jobs to keep the experience fast and reliable.

Phased Launch for Quality Assurance

Rather than a big-bang launch, Goosehead and Fueled agreed on a gradual rollout strategy. Goosehead’s data team was working in parallel to standardize policy data across their systems: a crucial step to ensure the app would display accurate information for everyone. Goosehead represents hundreds of insurance carriers across many different lines of business (home, auto, renters, etc.), and each unique client has different state by state and carrier by carrier variations—this complex dataset meant giving more time for every client’s specific requirements to be met.

We coordinated closely with Goosehead’s data team so that as soon as a cohort of customers met the data requirements, those clients would get access to the app. These early users effectively became a pilot group in production, allowing us to gather feedback and ensure everything worked smoothly at a smaller scale.

As part of our ongoing commitment to the success and stability of the app, Fueled also joined Goosehead’s support rotation: because of our global team, if a critical issue arose with the app out of hours, Fueled team members could jump in and fix it.

Results and Lasting Impact

The launch of the Goosehead Insurance mobile app marked a major milestone in the company’s digital transformation. For the first time, Goosehead’s clients have 24/7 access to their policy details on their own terms. No waiting on hold, no paperwork delays; a customer can pull up their auto insurance in seconds or chat with an agent in a few taps.

Goosehead’s mobile app is the first in the industry that gives clients one place to manage their policies across multiple carriers. Unlike other insurance apps, Goosehead’s mobile app empowers clients with clarity, education, and control across multiple policies and carriers in one unified platform. It’s designed to blend innovation with client-centric service, while also streamlining operational efficiency.

Fueled’s partnership with Goosehead is a prime example of our philosophy in action: we thrive on complex, data-heavy product design challenges, we obsess over delivering a polished user experience, and we integrate with our clients so closely that we function as one team. The result in this case was not just a successful app launch, but a transformation in how Goosehead approaches serving their clients digitally—and a collaboration set to continue through 2027.